How to Use an IRR Real Estate Calculator for Rental Property Analysis

Making informed expense conclusions is critical to maximizing returns while reducing risks. One powerful tool that financial analysts and investors use to gauge the profitability of potential opportunities could be the Central Rate of Get back (IRR). An irr real estate calculator is essential in aiding to streamline this process, providing quality and improving decision-making. But what precisely is IRR, and how can an IRR calculator enhance expense choices?

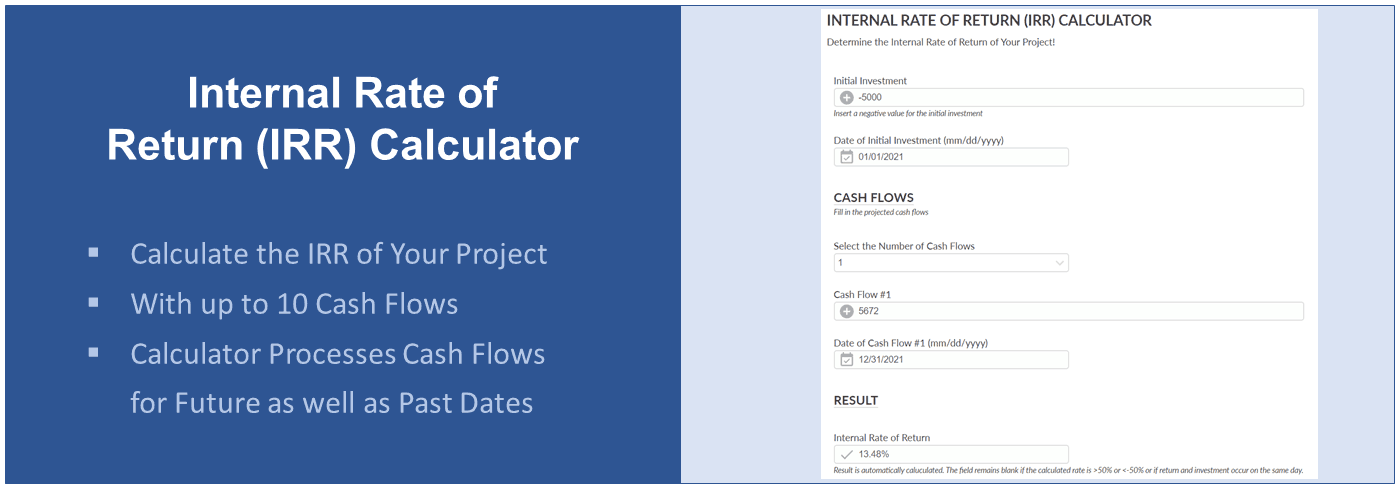

Understanding IRR The Internal Rate of Return (IRR) may be the discount charge at which the web present value (NPV) of an investment's cash moves means zero. In easier terms, IRR represents the rate of reunite at which an investor can expect to break actually on an investment, considering equally original outflows and future inflows. It's frequently applied to evaluate and comparison various investment opportunities or jobs, since it assists to recognize which investments will generate the highest get back over time. Why IRR is Essential for Investors IRR is a must because it offers just one, standardized full that can be applied across various kinds of investments. Investors typically strive for a higher IRR, because it signifies greater profitability. It's especially helpful when you compare jobs or opportunities with different timeframes and income movement structures, since it normalizes differences in size and duration. But, calculating IRR physically can be time-consuming and complex, specially for investments with changing money runs or long time horizons. This is where an IRR calculator comes into play. How an IRR Calculator Optimizes Investment Conclusions An IRR calculator can be an automated instrument designed to easily calculate the IRR of an investment, considering all relevant money inflows and outflows. Here's how it may improve your expense choices: Simplicity and Speed: An IRR calculator eliminates the complexity of solving for IRR manually, making the method quicker and more accessible. Investors only input the expected money flows and the tool does the rest. Accuracy: By using advanced algorithms, IRR calculators assure correct benefits, which can be essential to make high-stakes investment decisions. They minimize the danger of individual problem in manual calculations. Contrast: Several IRR calculators present the capability to feedback numerous investment circumstances, enabling you to evaluate the IRR of different jobs area by side. This can help you select probably the most lucrative investment opportunity. Situation Examination: Advanced IRR calculators enable you to conduct “what-if” analyses, changing assumptions like cash flow styles, discount prices, or investment durations to observe changes affect returns.

Conclusion In the present fast-paced financial earth, optimizing expense choices is paramount. The IRR calculator is an vital software that simplifies complicated calculations and empowers investors to create data-driven decisions. By giving accurate, rapid ideas in to the possible profitability of an expense, it helps investors to confidently spend resources to probably the most encouraging possibilities, ensuring better earnings and paid off dangers over the extended term.